This is STEP 2 to prepare you for CDS. You will first need to follow STEP 1, if you have not already done so.

The government has scheduled the long-awaited closure of the Customs Handling of Import and Export Freight (CHIEF) system for imports in September 2022 and exports in November 2023.

This will be replaced by the new Customs Declaration Service (CDS) for all declarations of goods departing from and arriving into Great Britain.

You will need to prepare in advance of 1st October 2022, or you will not be able to import goods into the UK. Please follow our step by step guides to prepare. Below is STEP 2.

STEP 2: Please follow this guide to arrange your financial accounts for CDS

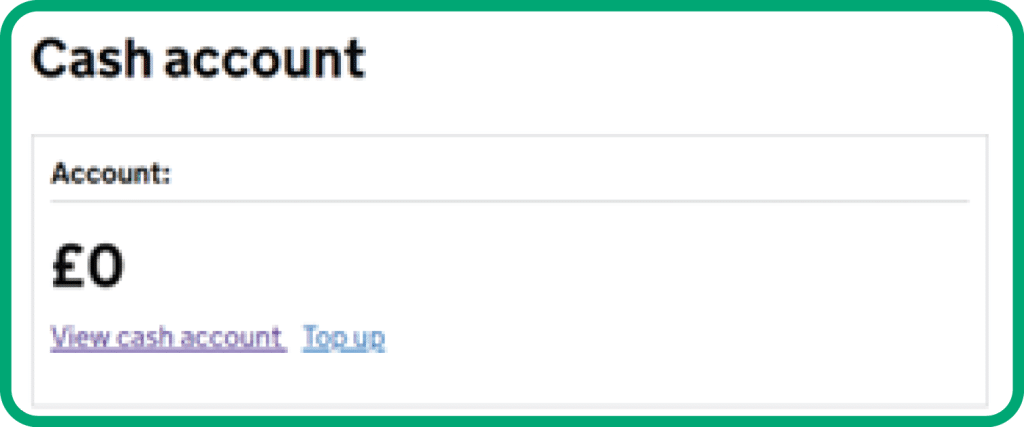

When you register for CDS you will automatically be provided with a Cash Account. The CDS Cash Account replaces the FAS payment service for immediate payments of duty and VAT on imports.

Your cash account will need to be topped up with a balance before you wish to use it.

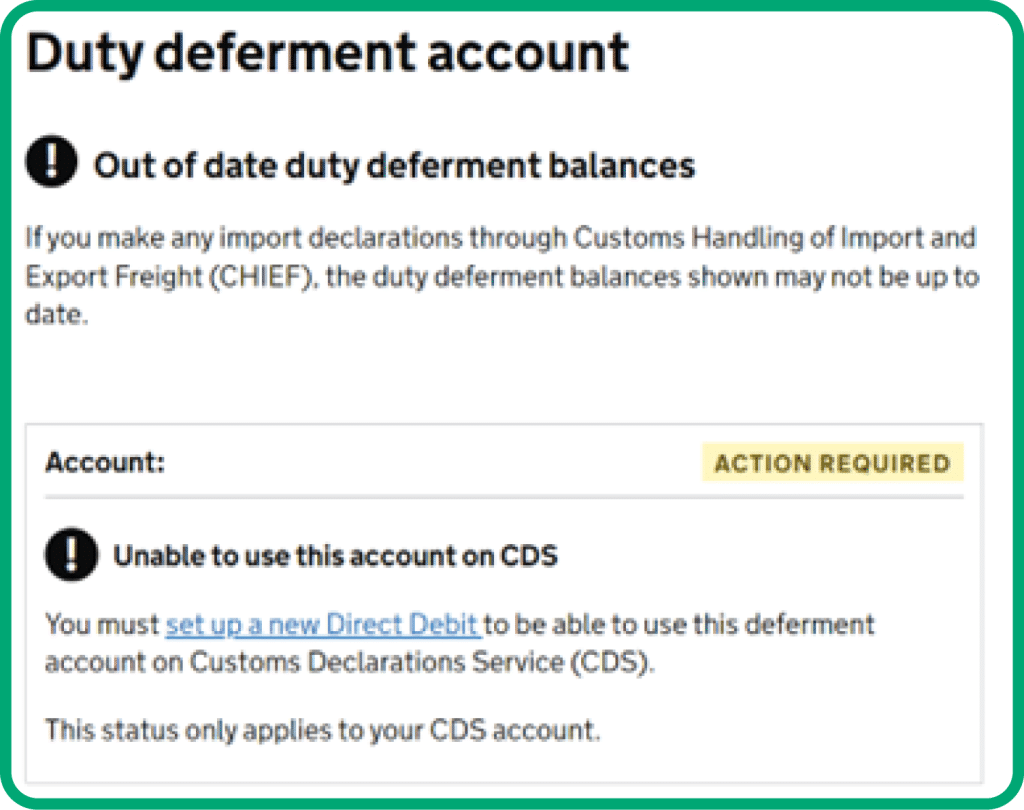

If you have a deferment account, you’ll need to arrange a new Direct Debit Instruction for declarations submitted via CDS. Your current DDI for declarations via CHIEF does not need to be cancelled before arranging for a CDS DDI.

You can access your financial accounts by logging in here.

To allow someone to make declarations on your behalf they will have to be provided with the account number for the CDS Cash Account or the Deferment Account Number depending on your method of payment.

You can find more information on the steps to take here:

STEP 1: Guide to registering for access to CDS

STEP 3: Providing a standing authority to use your financial accounts

If you have any questions, please contact us on CDS@goodlogisticsgroup.com